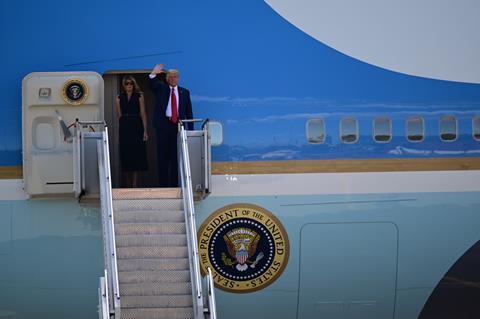

The aerospace industry is scrambling to secure exemptions from steep new tariffs being imposed by the Trump administration, saying the taxes will drive up prices and could cause years of disruption to an already fragile supply chain.

With sweeping new tariffs set to take effect in days, the sector is making the case that US aerospace manufacturing is unique because it trades at a surplus, meaning exports exceed imports.

Trump has largely described his tariffs as a means to address the USA’s broader deficit in the trade of goods, which he says has eroded US manufacturing. More tariffs, according to Trump, will revive US manufacturing.

“We continue to make a case to the administration, explaining to them the difference between aerospace and defence, and all other manufacturing sectors,” says Aerospace Industries Association (AIA) vice-president of international affairs Dak Hardwick. “It is meeting by meeting. It is call by call, to tell how we are different.”

“If there is this assumption that there is capacity in the domestic supply chain that can compensate or backfill all the supplies that are coming in from offshore, I think that’s an erroneous assumption,” adds Mark Norton, executive director of the Northwest I-90 Manufacturing Alliance, a Washington state group whose members include aerospace manufacturers.

President Donald Trump on 2 April said his administration will impose 10% tariffs on imports from all countries effective 5 April. Starting 9 April, the administration will slap additional “reciprocal” tariffs against countries “with which the United States has the largest trade deficits”, the White House says.

Some of the Trump administration’s new “reciprocal” tariffs, which are calculated to directly address trade deficits with specific countries:

China: 34%

European Union: 20%

India: 26%

Indonesia: 32%

Israel: 17%

Japan: 24%

Malaysia: 24%

Philippines: 17%

The measures come after Trump last month slapped 25% tariffs on all imported steel and aluminium.

Notably, as of now, experts say most aerospace products coming to the USA from Canada and Mexico are exempt from all tariffs, as specified by the United States-Mexico-Canada Agreement, which Trump negotiated during his first term as president.

“What the administration’s actions have done is make everything for our sector more expensive. If it’s made of metal it is now more expensive. And we use a lot of metal,” says AIA’s Hardwick.

Aerospace insiders say Trump’s tariffs could indeed lead firms to add US manufacturing. But the process of shifting production to the USA from elsewhere would much time.

Harwick says it can take three years for new manufacturing sites to certificated and another ten years to be up and running.

And it is not like the USA has a robust excess of skilled aerospace workers. Rather, labour shortages are already keeping suppliers from meeting demand.

“The aerospace supply chain is highly complex, and because of the regulatory nature of this industry, you don’t switch suppliers quickly. This is something that is going to take a long time to unravel,” Norton says. “There’s a high level of concern because of how many products and components and assemblies are outsourced offshore.”

Suppliers could bear much of the tariff burden, with impacts vibrating up the supply chain to top-tier producers like Boeing, say experts.

Boeing did not respond to a request for comment. But on 2 April Boeing chief executive Kelly Ortberg told a Senate committee that 80% of content used by Boeing comes from the USA and that 80% of its deliveries are to non-US customers.

Speaking on 3 April, United Airlines chief executive Scott Kirby expressed a bit of optimism, saying, “The goal of creating great middle class careers is a laudable one”.

Others are struggling to see a bright side.

“I’m astounded by the stupidity on display today,” Kevin Michaels, managing director of aerospace consultancy AeroDynamic Advisory, said in a 2 April post on LinkedIn, referring to the tariffs. “This will not end well. Inflation and a trade war are on the way at a time when the US is killing it in the global economy.”

Aircraft sales have been free of tariffs since 1980 in the USA and other countries that signed the Agreement on Trade in Civil Aircraft, AIA’s Hardwick notes.

He says aerospace is the “largest manufacturing sector in the United States that exports more than it imports”, making it a “net exporting industry” that helps offset the USA’s broader deficit in the trade of goods.

“We can prove that [a tariff-free aerospace industry] is good for the United States,” Hardwick says. “We are the production economy the administration is looking for.”

Story updated on 4 April to note that Boeing CEO said 80% of Boeing’s content comes from the USA, not from without the USA.