Dear Editor,

In his Letter to the Editor, SN, April 9, 2025, “It’s the real exchange rate that matters”, Thomas Singh concludes correctly: “Misunderstood economics: Policymakers may conflate nominal stability with economic health. But it’s the real exchange rate that matters. With inflation, keeping the nominal rate fixed only makes the real rate appreciate—damaging competitiveness further.”

Singh has made a convincing case that the US$ shortage in Guyana is the natural result of the Bank of Guyana holding the rate at G$110/US$ by supplying US$ to fill the recurring excess demand gap.

But here’s the nontrivial question: if the G$ is allowed flexibility, around which rate would it settle down? This is not something that can be determined by theoretical reasoning, say, by a model, but from observation. Exchange rate markets are volatile, subject to intense speculation — Nigeria has that problem — and unless a country has a well-developed foreign exchange market to handle forward and future contracts, plus a big cushion of US$ reserves, the flexibility would be a disaster.

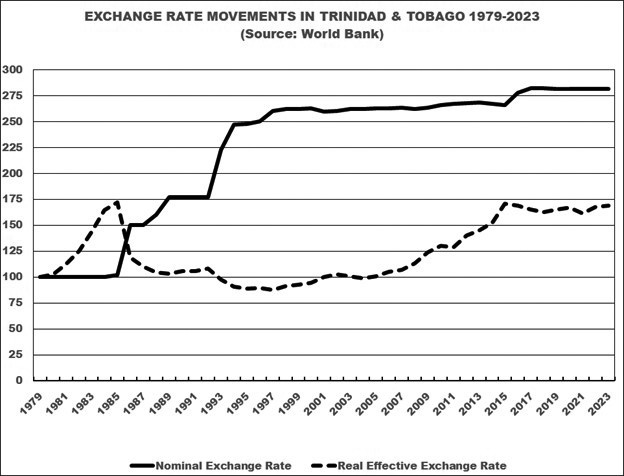

That said, does the qualification invalidate Singh’s argument? Not at all because the observation that we need is already there, in the past experience of Trinidad & Tobago. Between 2010 and 2023 alone, the real exchange rate appreciated 30% (dashed line), whereas the official TT$ depreciated by only 6% (the solid line). To be fair, due to the US$ peg, some of that overvaluation was the direct result of developments in the US$. But the overvaluation over a long period has done real damage to Trinidad and Tobago’s ability to develop a non-oil manufacturing sector to replace oil and gas.

A serious concern is whether Guyana’s official inflation data reliably captures actual price movements that would give a good measure of the real exchange rate.

A final comment relates to the suggestion of full dollarisation where the US$ fully replaces the G$. There are plusses and minuses. While the US$ shortage goes away, Guyana hands over monetary policy entirely to the U.S. Fed. So, if another pandemic were to happen, Guyana like Panama, would be powerless to lower interest rates to prevent a recession as there will be no traditional central bank like the Bank of Guyana.

Sincerely,

Terence M. Yhip