Here are the latest developments in global markets:

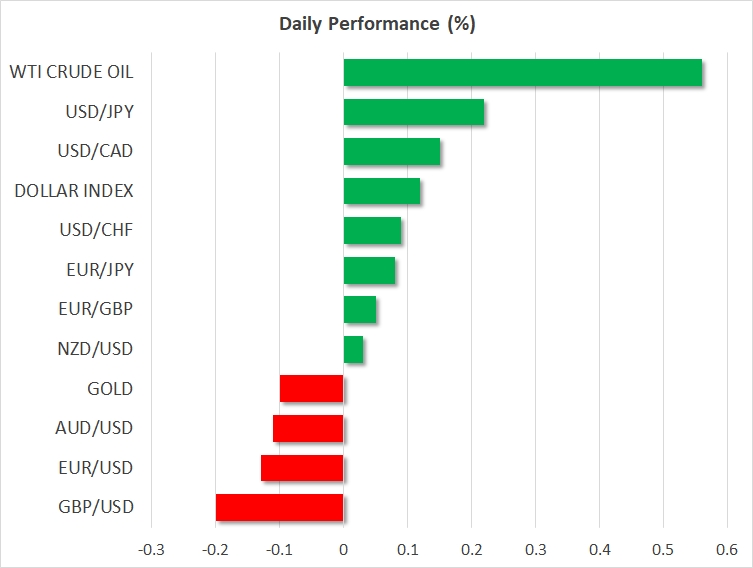

- FOREX: The US dollar index is a little more than 0.1% higher on Tuesday, trying to build on the modest gains it posted in the previous session. The British pound nosedived yesterday, following news that UK Foreign secretary Boris Johnson had resigned, with sterling/dollar also being 0.2% lower today.

- STOCKS: US markets closed higher on Monday, in the absence of any concerning trade-related headlines to dent risk appetite. The Dow Jones outperformed, gaining 1.31%, while the S&P 500 and Nasdaq Composite both advanced by 0.88%. The risk-on environment seems to have lingered, as futures suggest that the Dow, S&P, and Nasdaq 100, are all set to open higher today as well. Asian equities took their cue from their US counterparts, with almost all major indices being in the green on Tuesday. In Japan, the Nikkei 225 and the Topix climbed by 0.66% and 0.25% respectively, while in Hong Kong, the Hang Seng rose 0.51%. The same holds true in Europe, where futures suggest most major benchmarks are due to open a little higher today.

- COMMODITIES: Oil prices are higher on Tuesday, with WTI and Brent crude advancing by 0.57% and 0.73% respectively, amid news that a workers’ strike in Norway could impact the nation’s oil production. While the loss of supply is not expected to be massive, it comes on top of supply disruptions in Canada, Libya, Venezuela, as well as sanctions on Iran, and hence may have attracted more attention than otherwise. In precious metals, gold is down by 0.1% today, trading close to the $1,256/ounce level. It managed to touch a two-week high of $1,265 yesterday, but gave back most of those gains before the session ended, pressured by a strengthening US dollar.

Major movers: Pound dives after UK Foreign secretary resigns; risk appetite stays firm

The UK political climate is changing rapidly. Whereas the pound took the resignation of Brexit secretary Davis as a positive sign, reinforcing the notion that the tide was shifting in favor of a “smoother” Brexit, that narrative got turned on its head after Foreign secretary Boris Johnson resigned yesterday. He quit in protest at PM May’s new Brexit plan, arguing it maintains too-close ties with the EU. His departure – at least from the market’s perspective – was perceived as raising the likelihood for a rebellion within the Conservative Party that challenges Theresa May’s position as PM.

Such a revolt, by extent, could also keep the Brexit negotiations in a deadlock, as any Tory Brexiteer that potentially replaces PM May is unlikely to adopt her new “smooth” Brexit plan. Sterling plunged on the news, with euro/sterling briefly touching a four-month high as the probability of a no-deal Brexit was probably seen as rising. The currency rebounded somewhat after the Conservative Party Chairman said he doesn’t expect a leadership change, with heightened expectations that the BoE will raise rates in August likely playing a large role in limiting any greater losses in the pound as well.

The broader market showed little response to the UK political turmoil, with risk appetite remaining firm in the absence of any worrisome trade-related news. Major US stock markets closed higher, while the safe-haven Japanese yen lost ground against the euro as well as the dollar, posting a new six-week low against both.

The dollar index, meanwhile, managed to snap a four-day losing streak and close in positive territory on Monday, possibly drawing some strength from an uptick in longer-term Treasury yields. In US political news, President Trump nominated Judge Brett Kavanaugh for the Supreme Court, with a potential confirmation seen as putting the court on a more conservative path on social issues, such as abortion rights.

Elsewhere, the euro advanced against most of its major peers on Monday, amid a flurry of remarks from ECB officials – most notably Mario Draghi – reiterating their confidence in the eurozone’s economy and reaffirming a gradual path towards normalization.

Day ahead: UK industrial and manufacturing production, German ZEW survey and US JOLTS job openings on the agenda

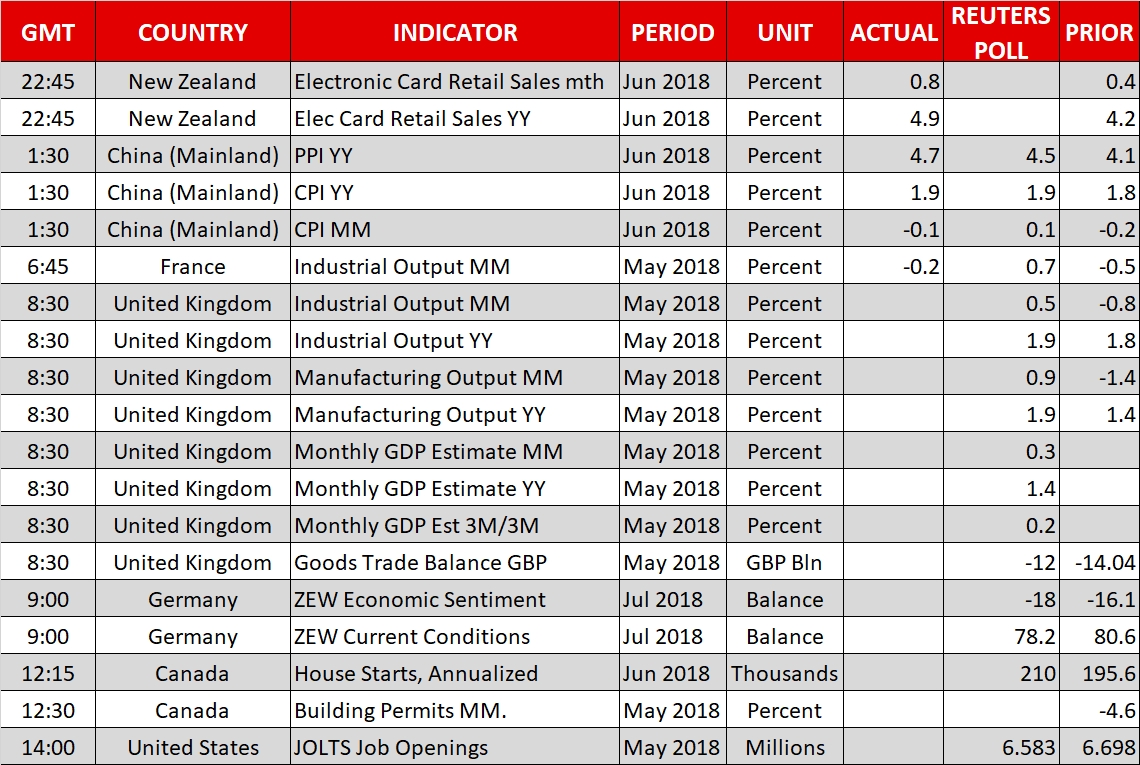

UK industrial and manufacturing output data, the ZEW surveys gauging business morale in Germany and JOLTS jobs openings out of the US are on Tuesday’s agenda.

May’s industrial and manufacturing production data – the latter being a subset of the former – will be made public out of the UK at 0830 GMT. A rebound in activity is projected by analysts after factory output recorded its worst month since late 2012 during April. Specifically, industrial and manufacturing production are anticipated to expand by 0.5% and 0.9% m/m, after contracting by 0.8% and 1.4% m/m respectively in April. An improvement is also forecast in the annual growth figures. Stronger readings are likely to stoke rate hike expectations by the Bank of England during its upcoming August meeting, consequently supporting the pound. The probabilities for a rate increase during the aforementioned meeting, which are also expected to be sensitive to political/Brexit developments, currently run close to 60% according to UK overnight index swaps.

The numbers on the UK’s May goods trade balance are also due at 0830 GMT; a narrowing of the relevant deficit is being forecast by analysts.

The ZEW institute’s surveys on business sentiment in Germany, the eurozone’s largest economy, are slated for release at 0900 GMT. Both the economic sentiment and current conditions indices are expected to deteriorate in July. In particular, the economic sentiment index is projected to stand at -18.0, its lowest since 2012. The threat of tariffs by the Trump administration is one of the factors that has weighed on morale in the past and may continue doing so.

Out of Canada, data on June’s housing starts and May’s building permits are due at 1215 GMT and 1230 GMT correspondingly.

The US will be on the receiving end of the JOLTS job openings report at 1400 GMT. The number of openings is expected at around 6.6 million, down from April’s record high of around 6.7m, but still at robust levels.

ECB executive board member Sabine Lautenschlager will be giving a speech at 1700 GMT, while San Francisco Fed executive vice president Mary Daly will be talking on the US economy and its outlook before the local CFA Society at 2200 GMT.

In equities, PepsiCo (NASDAQ:PEP) is among companies releasing quarterly results; the firm’s report will be made public before the US market open.

In energy markets, API data on weekly crude stocks are due at 2030 GMT.

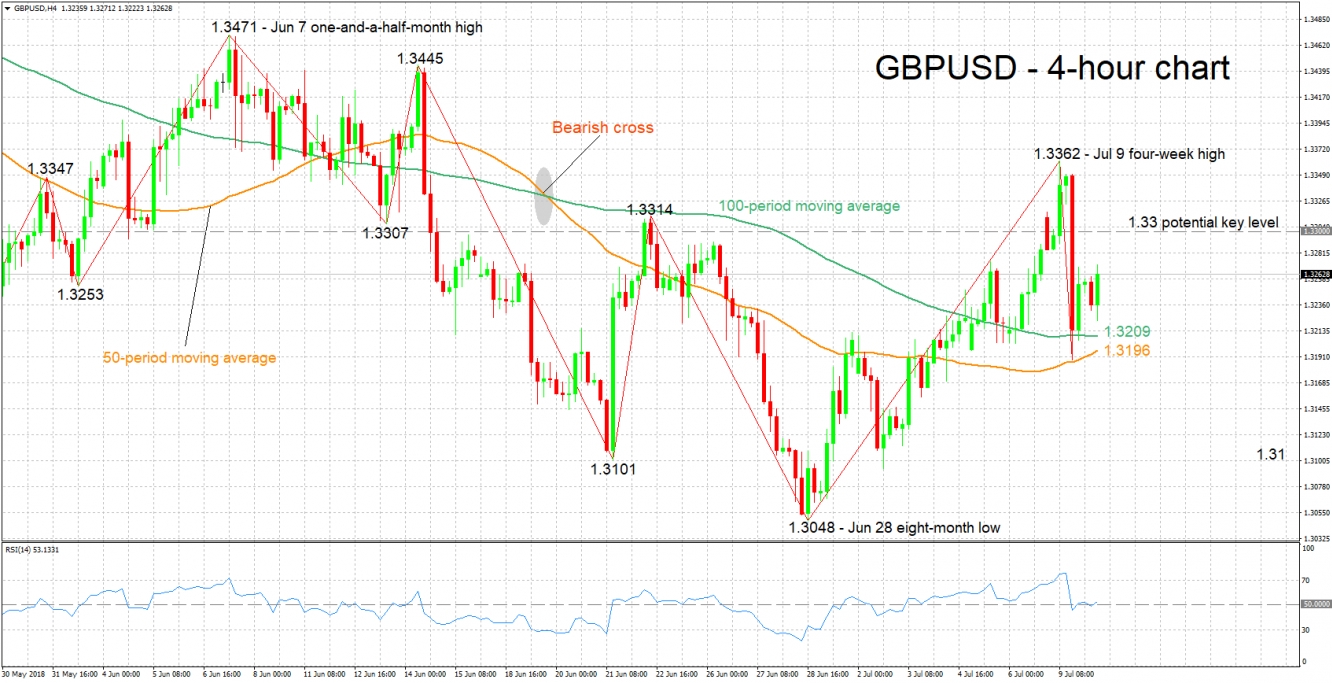

Technical Analysis: GBP/USD looking neutral in the near-term

GBP/USD has recovered somewhat after hitting a near one-week low of 1.3188 on Monday. The RSI is moving sideways after yesterday’s sharp fall, projecting a mostly neutral picture in the short-term at the moment.

Better-than-anticipated readings out of the UK later in the day are likely to boost the pair, with resistance potentially coming around the 1.33 round figure. In case of stronger bullish movement, the attention could next turn to yesterday’s four-week high of 1.3362.

On the downside and in the event of weak UK prints, support may come around the current level of the 100-period moving average line at 1.3209. Notice that the 50-period MA at 1.3196 (and consequently the 1.32 handle) are also part of the area around this level. Further below, the 1.31 mark would increasingly come into scope.

Data on US job openings can also move the pair.