KEY HIGHLIGHTS

Dr. Bharrat Jagdeo served as Guyana’s 7th Executive President for the period August 1999 to December 2011. Prior to his ascension to the Presidency, he served as Junior Minister of Finance (1993–1995), Senior Minister of Finance (1995–1997), and Second Vice-President, (1997-1999). During his tenure as President:

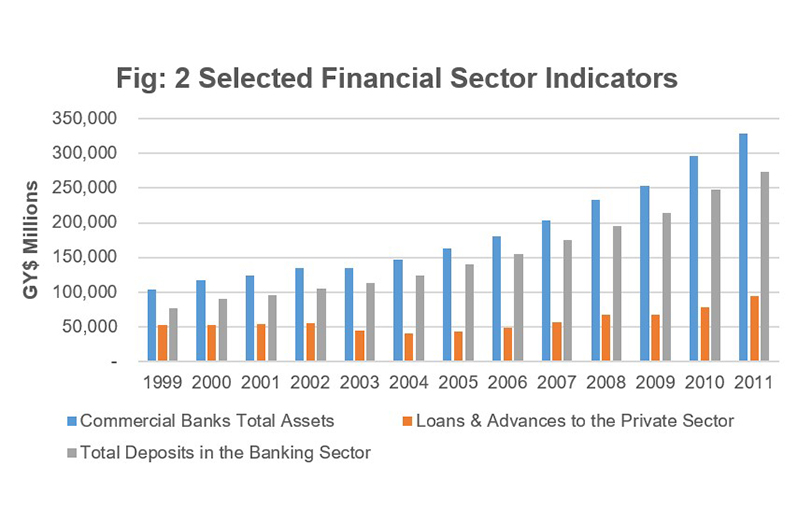

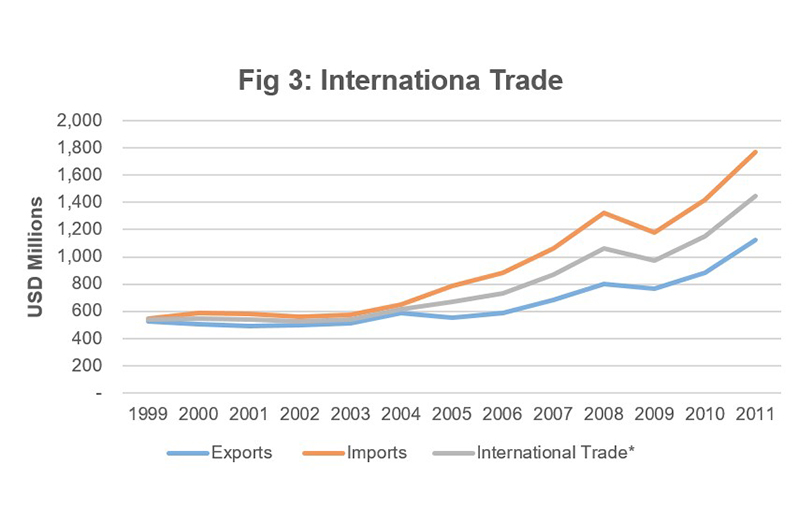

Commercial banks total assets grew from a position of $104 billion in 1999 to $328 billion in 2011 (215% or 3.2x); loans and advances to the private sector grew from a position of $52 billion in 1999 to $94 billion in 2011 (81% or 2x); total deposits in the banking sector grew from a position of $78 billion in 1999 to $274 billion in 2011 (254% or 3.5x); and International trade for the period 1999-2011 recorded cumulative growth of 170% from a position of US$538 million in 1999 to US$1.45 billion in 2011.

From inheriting a bankrupt economy with virtually zero savings in the bank, President Dr. Bharrat Jagdeo exited Government leaving a total of $101 billion liquid cash in the Government Deposit Accounts in the banking sector by the end of 2011; Government Revenue through taxes increased by 205% from a position of $40 billion in 1999 to $122 billion in 2011; and Net international reserves rose by 301% from a position of US$187 million in 1999 to US$750 million in 2011.

In the legislative environment, more than 200 Bills were enacted, covering the financial, judicial, security, social and productive sectors, (approximately 140 Bills were enacted alone during the Ninth Parliament) in addition to a series of reforms to the Guyana Constitution.

Over 200 kilometers of new and existing integrated road networks constructed and rehabilitated in addition to the hundreds of community roads across the country.

More than 100,000 housing units/house lots distributed throughout the country, viz-á-viz, the development of new housing schemes and regularization of squatting areas.

Most notably, household income increased threefold from a position of an estimated $15 billion in 1999 to an estimated $46 billion in 2011; and individual savings in the banking sector increased nearly threefold (2.5x) from a position of $68 billion in 1999 to 170 billion in 2011.

BACKGROUND

BACKGROUND

This author has long established that one of the strategies of the political opposition and the like, is to discredit, and constantly attack the Vice-President Dr. Bharrat Jagdeo. Of recent, a number of authors have been trying to discredit his stewardship of the economy as President during the period 1999-2011, but have failed to do so credibly.

The fact is that no credible author would ever succeed in such an endeavour, because the historical facts cannot be disputed or erased, irrespective of the orchestrated attempts at distortion thereof.

It is important to note that when the PPP/C Government was elected in 1992, they inherited a bankrupt economy. At that time, the debt-to-GDP was 900%, debt service was over 150%, inflation was 87%, interest rate was nearly 40%, there was zero foreign exchange reserves and zero savings in the bank.

In 1994, the PPP/C Government had embarked on the formulation of a National Development Strategy (NDS), which was led by Dr. Jagdeo as finance minister at the time. The strategy was finalized in 1996, and its incremental implementation commenced immediately thereafter in 1997.

DISCUSSION AND ANALYSIS

The critics argued that the growth rates obtained during the period 1999-2011 were inflated due to the rebasing of GDP to 2006 prices. One writer sought to argue the case that due to the rebasing, the growth appeared to be significant, but was not real growth―intimating that it was artificial growth. Be that as it may, the rebasing argument put forward was at best distorted, flawed, non-technical and highly misleading.

Rebasing of the national accounts series (which includes GDP) is the process of replacing an old base year with a new and more recent base year. The base year provides the reference point to which future values of the GDP are compared. Importantly, GDP rebasing is a normal statistical procedure undertaken by the national statistical agency to ensure that national accounts statistics present the most accurate reflection of the economy as possible.

The key benefits of the rebasing exercise is that its results enables policy makers and analysts obtain a more accurate set of economic statistics that is a truer reflection of current realities, for evidence-based decision-making. Rebasing also reveals a more accurate estimate of the size and structure of the economy by incorporating new economic activities which were not previously captured in the computational framework.

To understand the need for rebasing of GDP, one has to understand and appreciate the mechanics of GDP and how to deconstruct GDP, which the critics have failed to address. GDP is the market value of all goods and services produced within a country’s economy in a given period of time.

There is nominal GDP and Real GDP. Nominal GDP typically reflect current prices, whereas real GDP is adjusted to account for price changes from inflation and deflation.

The GDP equation is: GDP = G + C + I + NE (where G represents Government spending, C represents Consumption expenditure by households, I represents Investments and NE represents net exports). There are three approaches to measure GDP: (i) the income approach, (ii) the expenditure approach and (iii) the production approach.

With the above in mind, real GDP from the 1990s up to 2006 was based on 1988 prices, until GDP was rebased to 2006 prices. As of now, GDP was rebased to 2012 prices.

Thus, in order to conduct a proper analysis, one would have to examine a number of other indicators: For example, the international trade balances, net international reserves (foreign exchange reserves), credit to the private and public sector, deposits in the banking sector, foreign direct investment (FDI), aggregate expenditure and/or aggregate income; and the indices of output for selected commodities.

In so doing, the confusion by non-technical writers on how to analyze the effects of the rebasing would be mitigated. More importantly, one would be able to ascertain the financial state of affairs of the economy during the period 1999-2011, as opposed to an isolated, distorted view of GDP growth during that period.

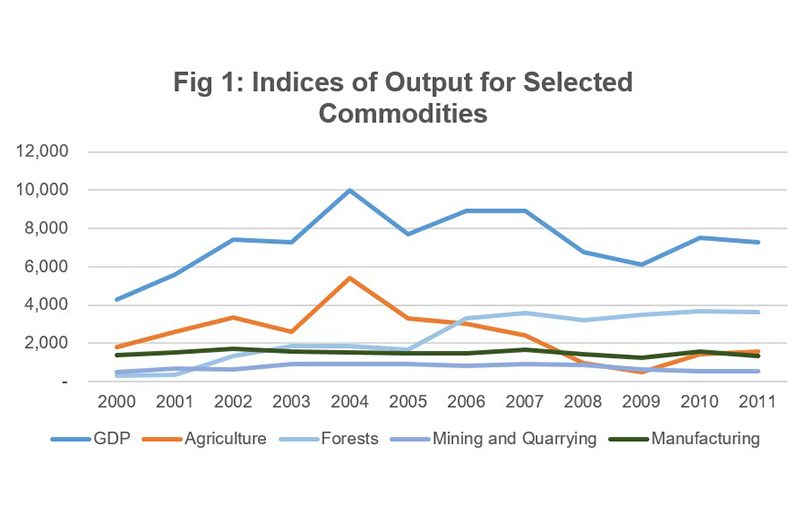

Towards this end, figure one shows the indices of output for selected commodities during the period 2000-2011. Accordingly, these indicators illustrated that the agriculture sector grew cumulatively for period 2000-2004 by 200%; the forestry sector grew cumulatively by 520%; the mining and quarrying sector grew cumulatively by 86%; and the manufacturing sector grew cumulatively by 10%. Overall, for that period the GDP for these sectors combined (excluding the services sector) grew cumulatively by 133%.

Towards this end, figure one shows the indices of output for selected commodities during the period 2000-2011. Accordingly, these indicators illustrated that the agriculture sector grew cumulatively for period 2000-2004 by 200%; the forestry sector grew cumulatively by 520%; the mining and quarrying sector grew cumulatively by 86%; and the manufacturing sector grew cumulatively by 10%. Overall, for that period the GDP for these sectors combined (excluding the services sector) grew cumulatively by 133%.

In 2005, GDP shrank by 60% due to the devastating 2005 flood. The years thereafter, coupled with adverse exogenous factors, the economy recovered slowly. Consequently, for this period, the GDP for these selected commodities (sectors) exclusive of the services sector showed that the economy grew cumulatively by 70%.

Similarly, the selected financial sector indicators in figure two showed signs of significant growth. For instance, the commercial banks total assets grew from a position of $104 billion in 1999 to $328 billion in 2011 (215% or 3.2x); loans and advances to the private sector increased from a position of $52 billion in 1999 to $94 billion in 2011 (81% or 2x); and total deposits in the banking sector rose from a position of $78 billion in 1999 to $274 billion in 2011 (254% or 3.5x).

Figure three above shows that international trade for the period 1999-2011 recorded cumulative growth of 170% from a position of US$538 million in 1999 to US$1.45 billion in 2011. Total exports increased by 115% from US$525 million in 1999 to US$1.12 billion in 2011, and total imports grew by 222% from US$550 million in 1999 to US$1.77 billion in 2011.

By the time President Jagdeo completed his second term in office, the economy’s debt-to-GDP was reduced from 900% (1992) to less than 50% (2011); the debt service to revenue ratio reduced from over 150% to 30%, inflation was reduced from 87% (1992) to 2% (2011), interest rates reduced from 30% (1992) to 11% (2011), exchange rates stabilized at G$200/USD$1, the net foreign reserves stood at US$750 million representing 5 months import cover from nil in 1992, GDP moved from US$300 million to US$3.7 billion (2011), per capita income increased from US$500, to US$4,900. From inheriting a bankrupt economy with virtually zero savings in the bank, President Dr. Bharrat Jagdeo exited Government leaving a total of $101 billion liquid cash in the Government Deposit Accounts in the banking sector by the end of 2011.

Additionally, Government Revenue through taxes increased by 205% from a position of $40 billion in 1999 to $122 billion in 2011; and the net international reserves rose by 301% from a position of US$187 million in 1999 to US$750 million in 2011.

It is worth highlighting, as well, that during President Jagdeo’s tenure, more than 200 Bills were enacted, covering the financial, judicial, security, social and productive sectors, (approximately 140 Bills were enacted alone during the Ninth Parliament) coupled with a series of reforms to the Guyana Constitution; over 200 kilometers of new and existing integrated road networks constructed and rehabilitated in addition to the hundreds of community roads across the country; more than 100,000 housing units/house lots distributed throughout the country, viz-á-viz, the development of new housing schemes and regularization of squatting areas.

Most notably, household income increased threefold from a position of an estimated $15 billion in 1999 to an estimated $46 billion in 2011; and individual savings in the banking sector increased nearly threefold (2.5x) from a position of $68 billion in 1999 to 170 billion in 2011.

CONCLUSION

Altogether, these outturns were attributed to sound macroeconomic policies and management of the economy, coupled with the developmental agenda, at a time when the financial resources of the country were constricted, and the challenges were many.